At the end of the day, it often looks so obvious. You find yourself thinking: “Why didn’t I buy here? Or there? The entries and stops were so clear… so why did I hesitate?”. That’s often the case with Small Pullback Trends can start at any time and can last for many bars — and yet, many traders stay stuck on the sidelines or try to fade them with countertrend scalps.

Today, we’ll do a quick case study of this very powerful trend type.

It doesn’t happen often, but when you recognize it, it’s an opportunity you can’t afford to miss.

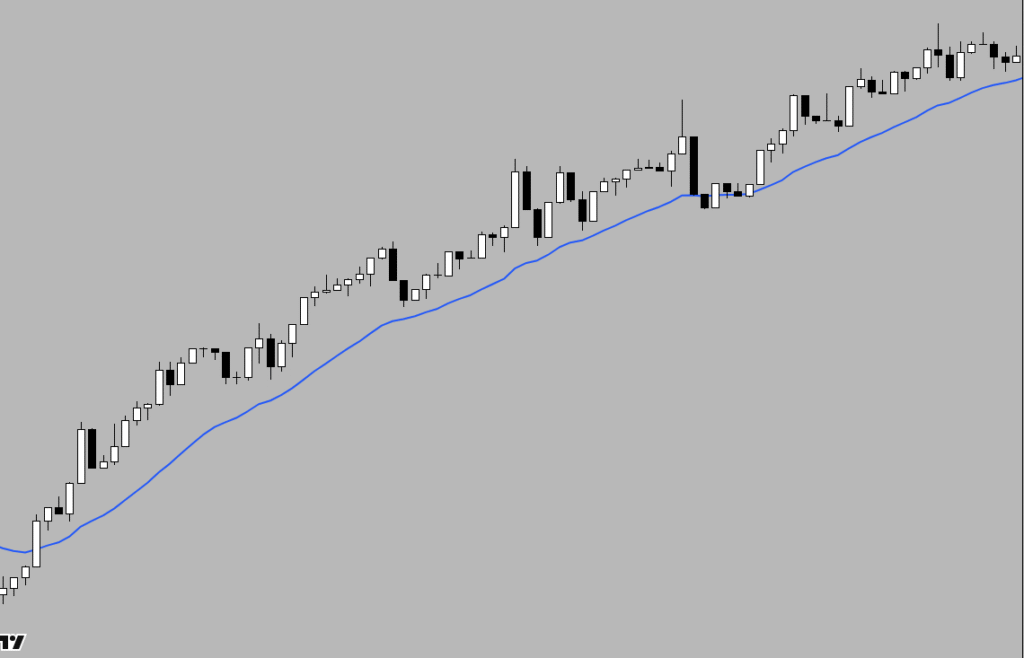

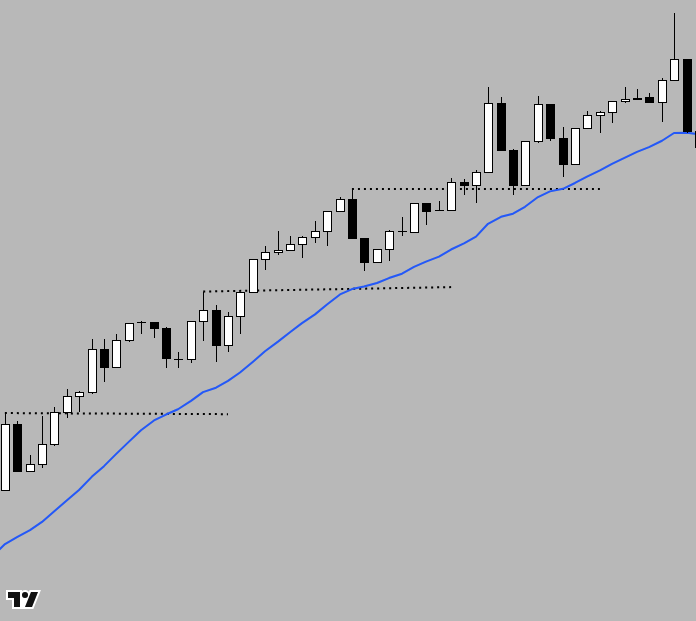

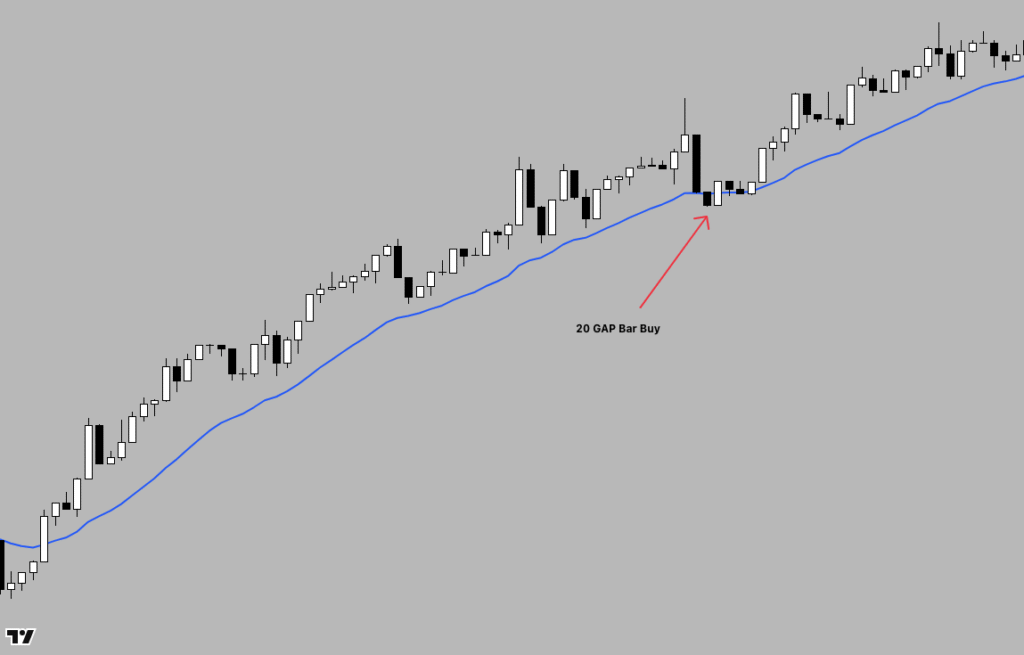

Below is the 5-minute chart of BTCUSD, where we can see the development of a Small Pullback Bull Trend:

1. Small Pullback Trends is a Breakout on Higher Time Frames

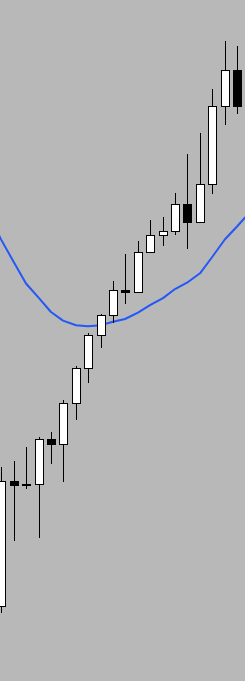

And here’s the 60-minute chart of BTCUSD — where we can clearly see the breakout formed by the Small Pullback Bull Trend.

Whenever you spot a Small Pullback Trend, remember: on a higher time frame, this is usually a breakout in progress.

2. Body Gaps

Another way to recognize a possible Small Pullback Trend is by spotting body gaps — a common sign of strong momentum.

You’ll often see multiple gaps remain open.

Limit-order bulls get trapped buying new highs and expecting reversals, but those reversals fail and become bull flags instead.

Sometimes bears also get trapped selling new highs, only to see price keep pushing up.

3. Moving Average Reversal

In a Small Pullback Trend, bulls will buy any of the following:

- The first touch of the moving average (MA)

- The first close below the MA

- The first reversal up at the MA

Strong bulls know there’s a high probability of profit, so they buy for any reason — and place their stops correctly.

Don’t waste the chance to trade one of the strongest — and most beautiful — trends you’ll ever see on a chart!

Final Thoughts

Small pullback trends may look obvious in hindsight — but trading them well requires you to read context, not just patterns.

If you focus too much on textbook entries, you’ll miss the real opportunities that happen bar by bar.

The strongest trends reward traders who can think in probabilities, manage risk, and stay with the move — without second guessing.

If this feels hard, that’s normal.

It’s a skill built with screen time, not only theory.

One bar at a time.

New here?

If you’re just starting to learn price action, these posts will give you a solid foundation:

- 5 Lessons I Wish I Knew Before Learning Price Action

- How to Learn Price Action Trading for Beginners

- Bar-by-Bar Reading: The Foundation of Price Action Trading

Small pullback trends may look simple, but to trade them well, you need to recognize pressure, context, and follow-through — skills you develop one bar at a time!