If you’re tired of cluttered charts and confusing indicators, price action trading might be exactly what you need. This approach strips everything down to what truly matters: the movement of price itself. In this article, you’ll explore price action trading strategies that are simple, effective, and grounded in market logic — no magic formulas, just clarity and structure.

Whether you’re just starting out or looking to sharpen your edge, these strategies will help you read the market with more confidence and make smarter trading decisions.

1. How Trends Reverse: Identifying Major Turning Points

A major trend reversal is more than just a trendline break. According to Brooks, for a real reversal to occur, the market must break a trendline and then test the prior trend extreme. This second test often traps late traders and offers smart entries in the opposite direction.

Visual representation of a major trend reversal after a failed high retest

Example:

A bullish trend ends, breaks the trendline, and tries to push to a new high. If it fails and forms a strong bearish reversal bar, that’s often a signal that institutional money is selling and a downtrend may begin.

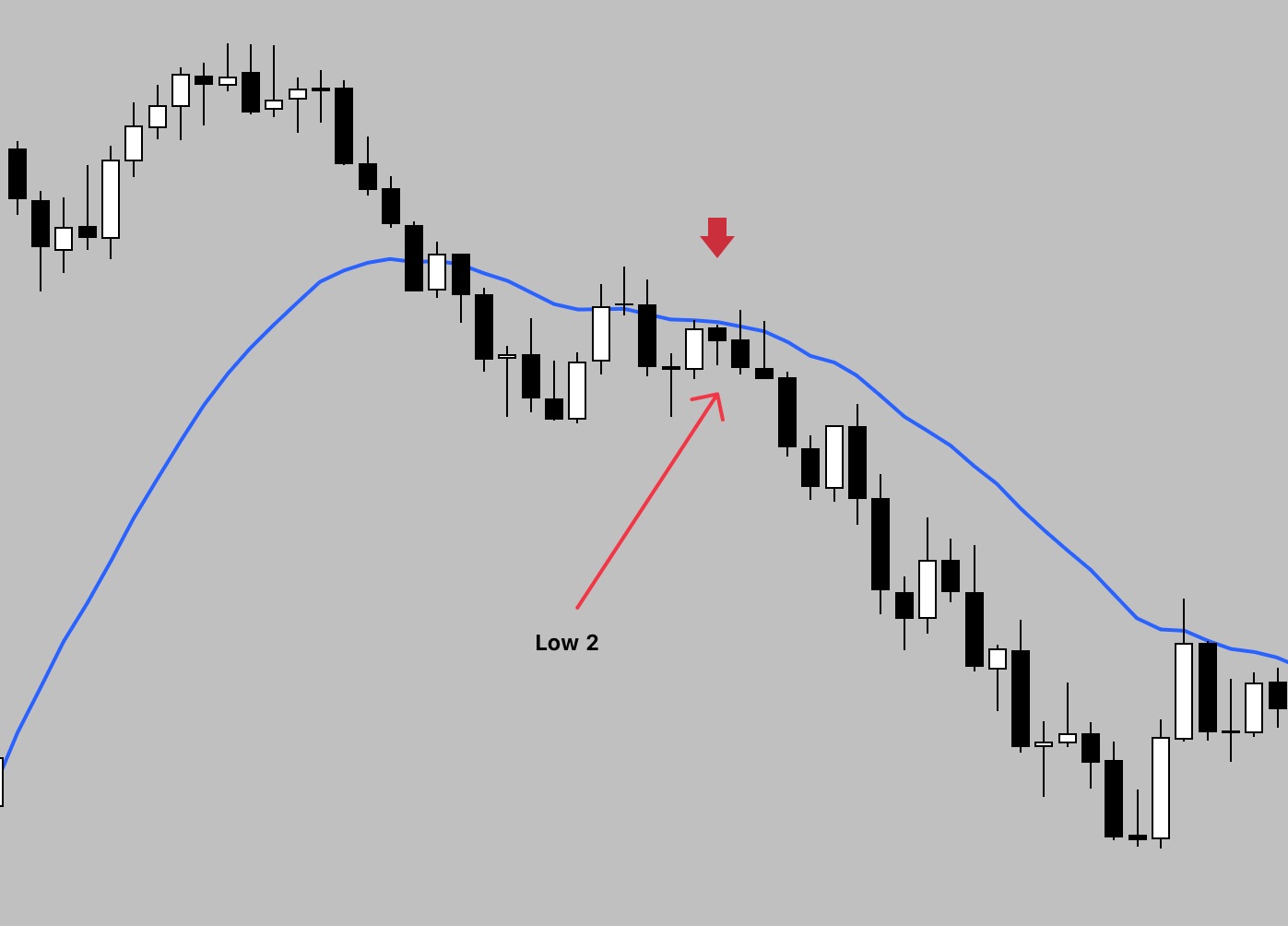

2. High 2 Bull Flags and Low 2 Bear Flags

These are classic second-entry setups. A High 2 is a bullish pattern that occurs after a pullback in an uptrend: the first bullish attempt (High 1) fails, but the second often leads to a successful rally. A Low 2 is the bearish equivalent during downtrends.

These patterns work especially well when they appear at support/resistance zones or trend extremes.

Visual example of a Low 2 entry during a bearish correction

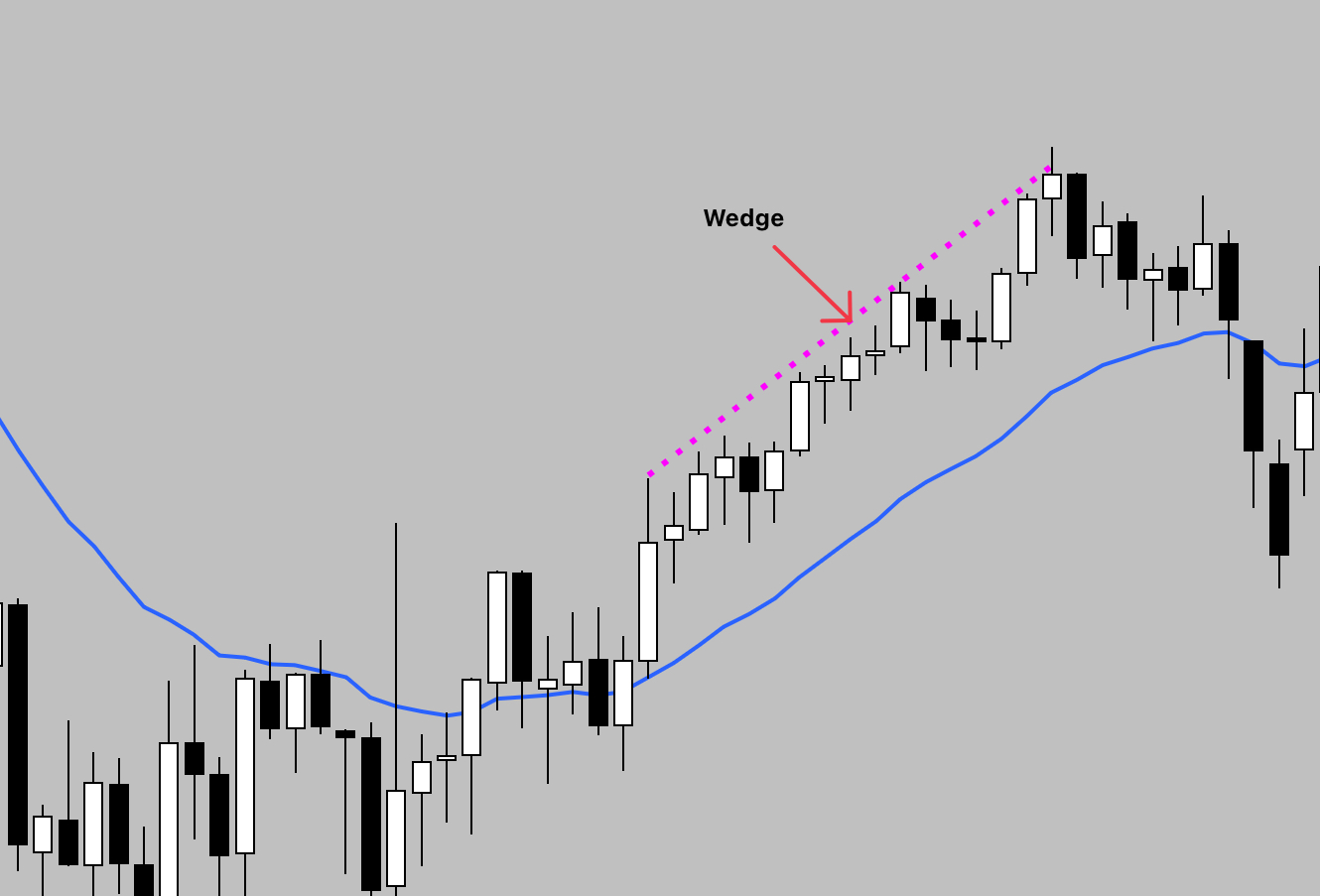

3. Wedges: A Powerful Price Action Trading Strategy

Wedges are exhaustion patterns made of three distinct pushes in one direction. Brooks teaches that when a trend becomes overly stretched — with each push becoming weaker — it’s often a signal of loss of momentum and a potential reversal.

Example of a wedge forming after a prolonged bullish move

- Bull wedge: Three weak pushes up = potential sell.

- Bear wedge: Three pushes down = potential buy.

Watch for a strong breakout in the opposite direction after the third leg.

4. Trading Range Reversals: Structure and Timing with Price Action

In sideways markets, the best trades often come at the edges. Brooks emphasizes watching for failed breakouts near the top or bottom of the range, followed by strong reversal bars.

Example of reversal setups within a sideways trading range

Tip: Fade the extremes. Buy near the range low, sell near the range high — but only when the market shows signs of reversal (e.g., tails, failed breakouts, or signal bars).

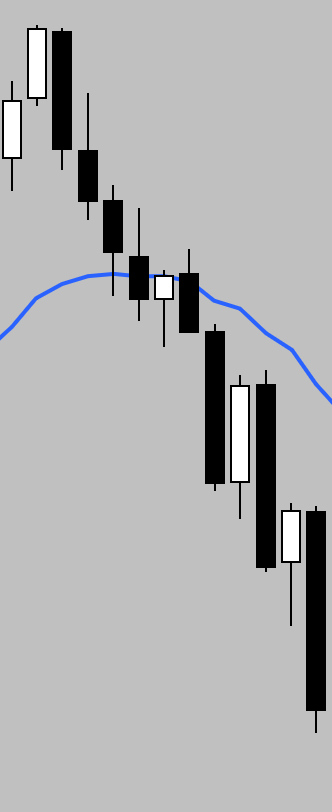

5. Breakouts With Follow-Through

Not all breakouts succeed. Brooks is very clear about this: look for strength.

A valid breakout setup includes:

- A strong breakout bar,

- Follow-through in the same direction,

- Strong breakouts often continue immediately, but when a pullback forms and holds, it can provide a second opportunity to join the move.

Bearish breakout with follow-through after a failed pullback to the moving average — a classic price action setup for trend continuation.

If a breakout pullback fails to hold and reverses sharply, it often traps traders on the wrong side — turning the move into a breakout failure with a tradable move in the opposite direction.

“The best setups are often the simplest — but not the easiest to spot.” – Al Brooks

Final Thoughts

You don’t need a dozen indicators to trade effectively. What you need is clarity, structure, and the discipline to wait for clean setups. These price action trading strategies aren’t about prediction — they’re about reading the market in real time and responding with confidence.

Each pattern discussed in this article reflects the behavior of institutional traders. Your job isn’t to outsmart the market — it’s to understand it and act with precision, patience, and consistency.

If you’re looking to go deeper and truly master the logic behind price movement, the

Brooks Trading Course is a great next step. It’s helped thousands of traders build a solid foundation using pure price action — no fluff, just method.

Want to go even further in your learning journey? Start here: How to Learn Price Action Trading for Beginners.

Ready to master the charts?

Start small. Focus deeply. Keep your journal honest.

Every setup you study, every trade you review — it’s all shaping the trader you’re becoming.

Trust the process. Your consistency is being built, one candle at a time.