Forget the lines. Focus on the logic.

Support and resistance are essential concepts in price action trading — but most traders draw them wrong, rely too much on indicators, or ignore context. In this post, you’ll learn how to trade support and resistance using price action alone — no indicators, just logic, structure, and context.

Let’s break it down the Price Action way: context first, logic always, and no guessing.

Support and Resistance Are Not Magical Levels

Forget the idea of a level “holding” because it’s some kind of magic. Support and resistance work when there are enough traders acting on similar expectations — often around prior highs, lows, or trading range extremes.

- Support is not where price must bounce. It’s where it might, if buyers are strong enough.

- Resistance is not where price must reverse. It’s where sellers may step in — or not.

The key is this: price action shows you how the market reacts to these levels — not just where they are.

They’re Not Just Horizontal Either

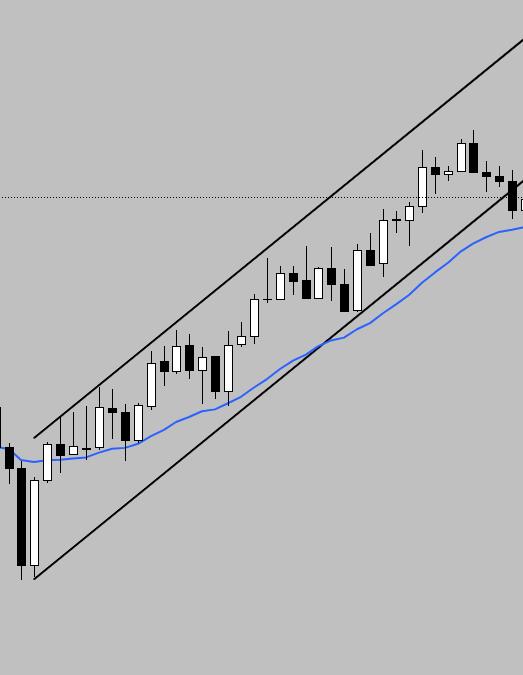

Most traders draw horizontal lines across prior highs and lows. That’s useful, but incomplete. Price often respects dynamic support and resistance too — like trend lines, moving averages, or even micro channels.

- The 20-bar EMA often acts like a dynamic support.

- In a tight bear channel, resistance might “slide down” with the trend — not stay flat.

- Context tells you what the market is favoring: bounces, breakouts, or traps.

Look for Reactions, Not Lines

Price action doesn’t care about your lines. It reacts to where traders commit money. So instead of asking “where’s support?”, ask:

- Is the market testing a prior low with strong reversal bars?

- Are we seeing a wedge bottom or a micro double bottom?

- Are bulls buying aggressively into the pullback?

Support is confirmed by behavior, not location. Same with resistance.

Support Can Fail. And That’s a Setup.

A common mistake is to treat support like a guarantee. But when support breaks and the market keeps falling, it’s not random — it’s a clue.

The failure of support often turns into a signal:

- A failed breakout below support can trap bears and fuel a bull rally.

- A clean break with no rejection? That tells you the sellers are in control — and the prior support is now resistance.

Understanding the flip of roles (support becomes resistance, and vice versa) is key. But don’t trade it blindly — wait for the price action to confirm.

Context Makes the Level Meaningful

A swing low is not always support. A double top is not always resistance. Without context, these are just shapes. What matters is what the market has been doing and what traders expect to happen next.

Ask yourself:

- Is this area part of a larger trading range?

- Are we in the middle of a breakout attempt?

- Is this level acting as a magnet or a barrier?

The more you read the chart as a story — not a static map — the more accurate your interpretation of support and resistance becomes.

Many traders who go deep into price action end up studying the methodology behind it. One of the most well-known is the Brooks Trading Course, which helped popularize this kind of bar-by-bar reading.

Final Thoughts

Support and resistance are not fixed. They evolve, they fail, they trap.

The traders who succeed with price action aren’t the ones with perfect lines — they’re the ones who know how to read behavior around those lines.

Don’t just look for places where price bounced in the past. Look for how it’s reacting now. The strength of the response tells you more than the level itself.

Want to learn to read that response with clarity?

Start with Bar-by-Bar Reading — it’s where real price action trading begins.