When you look at a chart, what do you actually see?

Most traders search for ready-made patterns — breakouts, triangles, perfect-looking bars. But those who study price action seriously, especially through Al Brooks’ methodology, rely on bar-by-bar reading to uncover what each price bar reveals about the market.

Reading bar by bar means listening to the conversation between bulls and bears — understanding who’s gaining ground, who’s giving up, and where the next trap is about to snap shut.

What Does It Mean to Read “Bar-by-Bar”?

It means interpreting each bar within context, based on the forces behind it. It’s not about memorizing visual formations — it’s about learning the market’s real-time language.

Professional traders observe:

- The direction of the bar (close vs open)

- The tails: rejection at one end?

- Relative size: is it a dominant bar or a hesitation?

- The location: where is it forming? In trend? In a range? After a trap?

Key Bar Types in Serious Price Action Trading

1. Signal Bar

The bar that suggests a possible trade entry — but not every bar qualifies.

Example: A strong-bodied bar, no opposite tail, forming in trend, closing near its high or low.

Weak signals? Small bodies, conflicting tails, or bars showing up in confusing price zones.

2. Entry Bar

The bar that triggers the trade — typically by breaking above or below the prior signal bar.

If the entry fails immediately, it’s a clue: experienced traders may have been waiting for the opposite move.

3. Trend Bar

A bar with a strong body and little pullback.

It shows conviction — from either bulls or bears.

Multiple trend bars in a row? Often the clearest sign that one side is dominating.

Can mark the end of a move — but only if the context supports it. A single bar against trend means nothing on its own. You need:

4. Reversal Bar

- A strong location (e.g. range extreme, at the end of a pullback)

- Visible weakness in the dominant side

- Lack of follow-through after a prior strong move

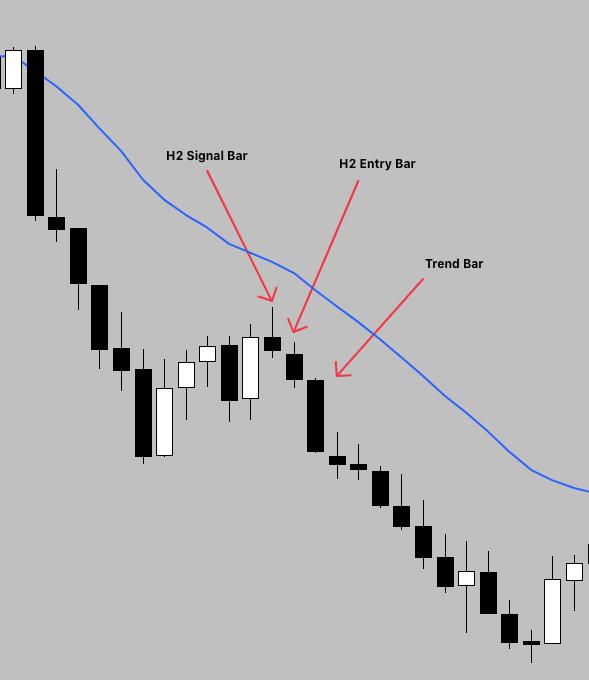

The example below shows how different bar types unfold after a successful reversal. You’ll see a signal bar triggering a pullback entry (H2), followed by a clean trend bar — a classic sequence in bar-by-bar reading.

Bearish H2 setup following a reversal. Signal bar, entry bar, and trend bar highlight how traders read momentum and continuation one bar at a time

Context Is The Final Judge

A bar only matters when read as part of a larger story. Bar-by-bar reading is not about “predicting the next bar” — it’s about:

- Seeing who is pressuring the market

- Understanding if a move has room to continue or is about to be tested

- Spotting where trapped traders will panic and fuel your trade

Why This Changes The Game

Reading bar by bar puts you in the mindset of professional traders.

You stop relying on lagging indicators, rigid setups, or blind guesses.

You start making decisions based on what’s really happening — right now.